Let’s delve into the exciting world of obesity drug stocks. These pharmaceutical companies are at the forefront of developing treatments for obesity, a significant health challenge worldwide. Here’s what you need to know:

- Novo Nordisk (NVO):

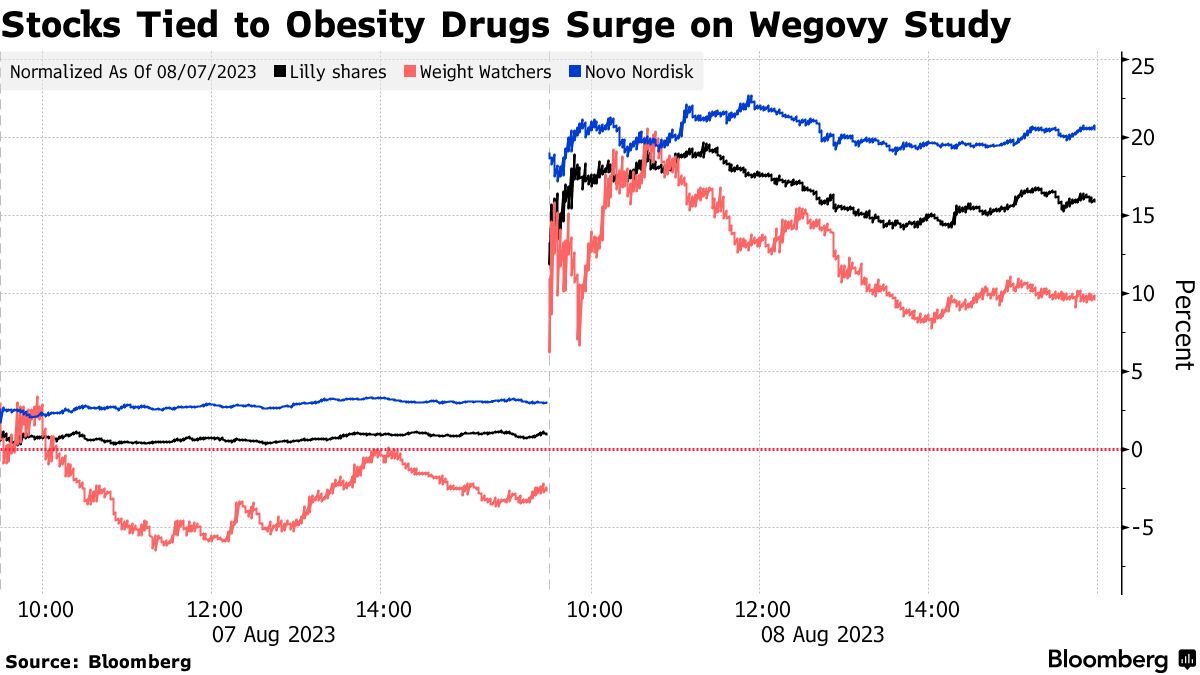

- Novo Nordisk is a major player in the obesity drug market. They produce Ozempic and Wegovy, both of which have garnered attention for their efficacy in weight loss.

- Year-to-date performance: Novo Nordisk’s stock has surged by 60.6%1.

- Valuation: While Novo Nordisk is a strong contender, it’s essential to note that its stock currently trades in overvalued territory1. Investors should weigh this factor carefully.

- Eli Lilly (LLY):

- Eli Lilly manufactures Mounjaro and Zepbound, two weight-loss drugs that have shown remarkable efficacy.

- Year-to-date performance: Eli Lilly’s stock has experienced an impressive rally, with gains of 78.1%1.

- Valuation: Eli Lilly’s stock is also trading at a premium, reflecting the market’s optimism about its weight-loss therapies1.

- Other Players:

- Pfizer (PFE): Pfizer is exploring its own obesity drugs, although its stock has faced challenges recently, with a negative 17.9% performance1.

- Amgen (AMGN): Amgen is another contender, with a 44.7% gain in its stock price1.

- Roche (RHHBY): Roche’s stock performance has been less favorable, with a negative 14.7% return1.

- The Obesity Epidemic and Drug Development:

- Historically, obesity drug development has been challenging, but recent innovations have changed the landscape.

- Both Novo Nordisk and Eli Lilly have achieved unprecedented efficacy in their weight-loss drug therapies, leading to increased investor interest1.

- The launch of Novo’s previous obesity drug, Saxenda, was less successful, but the current momentum suggests a different outcome this time1.

- Investment Considerations:

- Investors looking to capitalize on this potentially significant market must weigh the valuation of these stocks.

- While Novo Nordisk and Eli Lilly are strong contenders, their current prices may not fully account for potential risks, including price declines, competition, and patient discontinuation due to tolerability or safety concerns1.

- Keep an eye on new clinical trial data and developments in this space.

In summary, both Novo Nordisk and Eli Lilly offer exciting opportunities, but investors should carefully assess their valuations and consider long-term prospects. Remember that investing involves risks, and thorough research is essential before making any decisions. 🚀💼📈